A new report from Bloomberg New Energy Finance (BNEF) is crediting seven wind farms around the world, each costing between $600 million and $4.5 billion, with helping global clean energy investment jump 40% year-on-year in the third quarter of 2017.

The latest authoritative figures from the BNEF database of deals and projects show that the world invested $66.9 billion in clean energy in Q3 – up from $64.9 billion in the second quarter of this year and $47.8 billion in Q3’16.

According to BNEF, the numbers for the quarter mean that investment in 2017 so far is running 2% above that in the same period of last year; this suggests that the annual total is likely to finish close to or a little ahead of 2016’s figure of $287.5 billion. This year looks highly unlikely, however, to beat the record of $348.5 billion reached in 2015, notes BNEF.

The standout move of the third quarter of 2017 was American Electric Power’s (AEP) investing $4.5 billion in Invenergy’s 2 GW Wind Catcher project in the Oklahoma Panhandle. Due to be completed by 2020, the project will have 800 turbines, connected to population centers via a 350-mile, high-voltage power line. AEP still needs to secure some regulatory approvals, but because construction has started, BNEF is treating the project as financed.

Amy Grace, head of North America research for BNEF, says, “Wind Catcher is an example of a regulated utility in a wind-rich area of the U.S. taking advantage of federal tax credits to build a project that will produce electricity at below the cost of its existing coal and gas generating plants.”

The other top asset finance transactions of the quarter were DONG Energy’s decision to proceed with the 1.4 GW Hornsea 2 offshore wind farm in the U.K.’s North Sea at an estimated $3.7 billion by the time it is completed, as well as Northland Power’s $1.6 billion financing of the 252 MW Deutsche Bucht array in German waters.

After those came two Chinese offshore wind farms (Guohua Dongtai and Zhoushan Putuo) totaling 552 MW and an estimated $2.1 billion; the Zuma Reynosa III onshore wind farm in Mexico at 424 MW and an estimated $657 million; and the 450 MW Coopers Gap onshore wind project in Queensland, Australia, at $631 million. The biggest solar project financing was an estimated $460 million for First Solar’s 381 MW California Flats PV project.

Breaking the quarter’s figures down by type of investment, asset finance of utility-scale renewable energy projects, such as those above, jumped 72% globally compared to the same quarter of last year and reached $54.3 billion. Small-scale project investment (solar systems of less than 1 MW) came to $10.8 billion in the latest quarter, up 9%, the report says.

The two other areas of investment that BNEF tracks quarterly are venture capital (VC) and private equity (PE) investment in specialist clean energy companies, as well as equity-raising on public markets by quoted companies in the sector. Both these areas had subdued activity in the third quarter, according to the report.

VC/PE funding was only $662 million in Q3 – down 79% from a very strong equivalent period a year earlier. The period of July to September 2017 was the weakest quarter for this type of investment since 2005, notes BNEF. The only deal to break three-figure millions was a $109 million private equity expansion capital round for Indian solar project developer Clean Max Enviro Energy Solutions.

Public markets investment was also subdued: It was down 63% year-on-year at $1.4 billion, representing its lowest quarter since the first quarter of 2016. The biggest equity-raisings were by Chinese company Beijing Shouhang Resources Saving to fund activity in solar thermal generation (a $675 million private placement) and a $314 million initial public offering by Greencoat Renewables, a Dublin-based investment company targeting operating-stage wind projects in Ireland and the rest of Europe.

Abraham Louw, associate for clean energy economics at BNEF, says, “The weak third quarter figure for public markets investment came ironically despite a strong performance from clean energy stocks, with the NEX index, for instance, rising 7.5 percent between the end of June and the end of September and now standing 22 percent up since the start of 2017.”

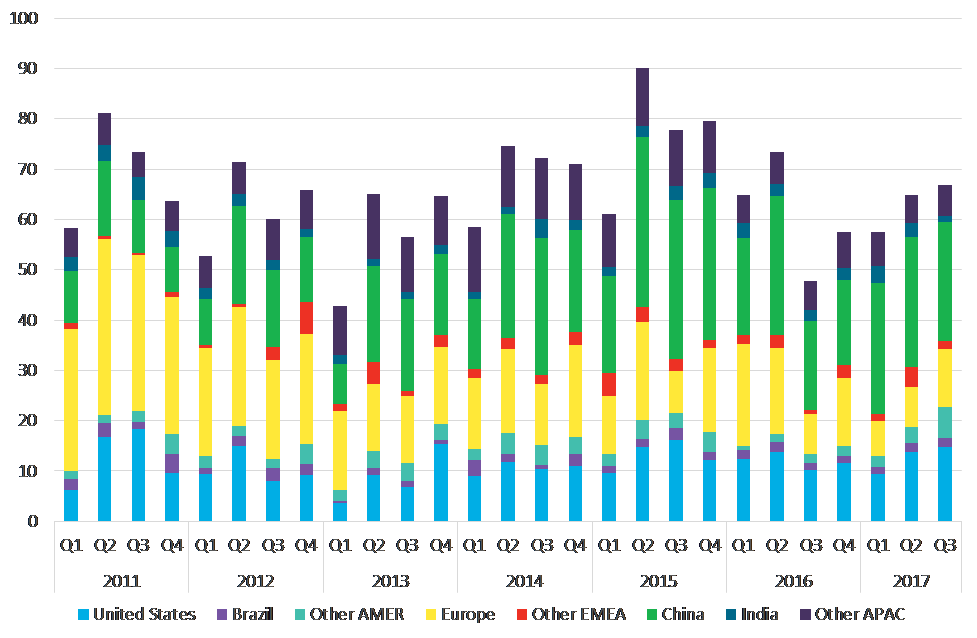

Global new investment in clean energy by region and by quarter in billions of dollars: