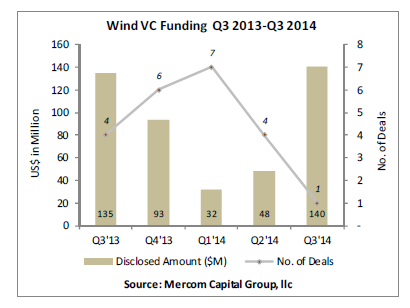

Global wind power venture capital (VC) funding reached $140 million in the third quarter of this year (Q3'14), compared with $48 million in Q2'14, according to a new report from Mercom Capital Group.

Global wind power venture capital (VC) funding reached $140 million in the third quarter of this year (Q3'14), compared with $48 million in Q2'14, according to a new report from Mercom Capital Group.

Notably, the entirety of the third quarter amount came in one deal as ReNew Power Ventures raised $140 million from Goldman Sachs Group, Asian Development Bank and GEF SACEF India. Total corporate funding in the wind sector, including VC funding, public market financing and debt financing, came to $2.4 billion in the quarter, down from $4 billion in the second quarter.

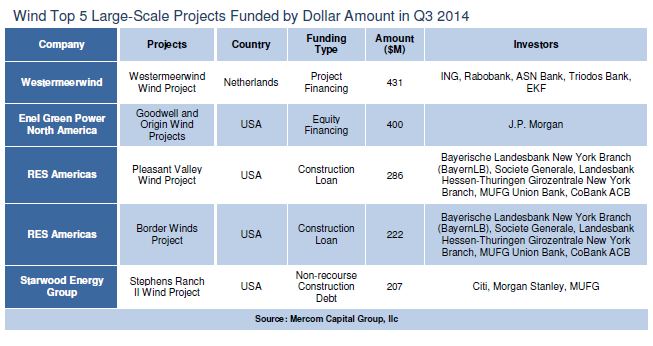

Announced large-scale project funding in the quarter dropped to $3 billion in 28 deals, compared to $6.3 billion in 38 deals in Q2'14.

Mercom says it also tracked nearly 10.9 GW of new project announcements globally this quarter in various stages of development.

The report says there were six mergers and acquisition (M&A) transactions in Q3'14, two of which disclosed amounts totaling $81 million. The top disclosed M&A transaction this quarter was the acquisition of Polish Energy Partners, a wind project developer, by CEE Equity Partners, a Chinese private equity fund, for $78 million.

According to Mercom, announced project acquisitions in the quarter was its lowest since 2010, coming in at $5.3 billion in 49 transactions (19 disclosed), compared to $1.4 billion in 31 transactions (11 disclosed) in Q2'14.

The report says the top five project acquisitions by disclosed amount were led by Laidlaw Capital Group, an investment firm, which signed a deal with Bard Group, a manufacturer, installer and operator of offshore wind turbines, to acquire the 400 MW Veja Mate offshore wind project in the North Sea for $1.3 billion.

That was followed by wind project developer Masdar Abu Dhabi Future Energy, which agreed to acquire part of Norwegian oil and gas company Statoil's stake in the 402 MW Dudgeon offshore wind project in England for $858 million.

A consortium of Danish pension funds, PKA, Industriens Pension, Laerernes Pension and Laegernes Pensionskasse, acquired 50% of the 252 MW German offshore wind farm project, Gode Wind 2, from DONG Energy, an offshore wind project developer for $812.7 million.

Mainstream Renewable Power, a renewable energy project developer, acquired the 225 MW Ayitepa wind project in Ghana from NEK Umwelttechnik, a Swiss wind project developer, for $525 million. Rounding out the top five was the $406 million acquisition of two Polish wind projects totaling 250 MW by China-CEE Fund and Enlight Renewable Energy, from GEO Renewables, a wind project developer.

There were two initial public offerings this quarter: CECEP Wind-power raised $63 million on the Shangai Stock Exchange and ELTECH ANEMOS, a Greece-based wind developer, raised $48 million on the Athens stock exchange.