The near-term U.S. wind power outlook is fairly clear, with a pipeline of more than 14 GW of high-probability projects supported by the now-expired federal production tax credit (PTC).

The near-term U.S. wind power outlook is fairly clear, with a pipeline of more than 14 GW of high-probability projects supported by the now-expired federal production tax credit (PTC).

However – assuming there is no renewal of the PTC – wind power's growth after 2017 will depend upon price. In particular, the outlook for U.S. wind power will depend on the levelized cost of energy (LCOE) when compared to natural gas combined cycle (NGCC).

Currently, the outlook for natural gas prices is much lower than the prices seen in winter 2014 when natural gas prices climbed higher than $6/MMBtu.

Since the beginning of this year, natural gas prices have dropped below $3/MMBtu, according to the Henry Hub natural gas spot market. What's more, natural gas prices are anticipated to go lower – as prices in global oil and gas markets remain depressed and the U.S. continues its supply glut from domestic shale gas production.

Nevertheless, the severity of weather also plays a role in natural gas price levels and could cause future spikes, especially in the winter seasons ahead.

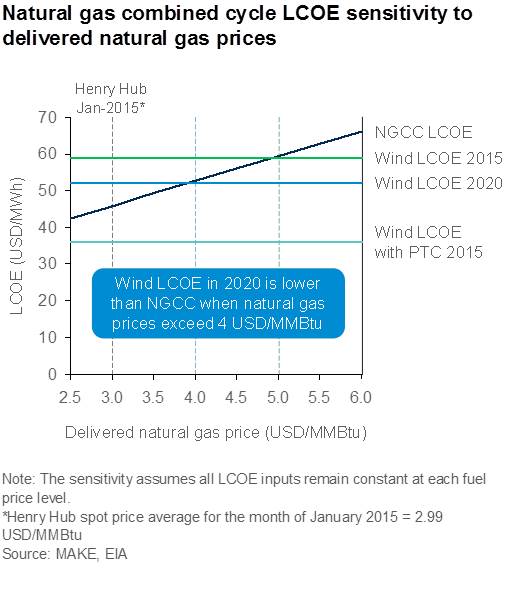

For power asset owners and investors, lower gas prices mean a reduction in operating costs for natural gas power. NGCC is the lowest-cost form of unsubsidized new power generation. In fact, prices can reach below $50/MWh aided by low fuel prices. This is more affordable than current unsubsidized wind power costs but higher than the LCOE of most projects with the PTC.

MAKE's 2015 LCOE model estimates that the typical unsubsidized LCOE of wind power in the U.S. will be $59/MWh in 2015, with individual projects falling within a range from $45/MWh to $90/MWh.

The PTC for wind energy helps to significantly lower costs through its credit of $23/MWh for the first 10 years of operation if an investor has a large enough tax burden to capitalize on the full credit. For investors that can fully utilize the tax credits, wind power with the PTC is one of the most lucrative investments in new power capacity, especially when tied to a long-term power purchase agreement.

Fast forwarding to a U.S. market without the PTC, wind power's LCOE will continue to decline – while the long-term outlook for natural gas prices is uncertain. The LCOE of NGCC is highly sensitive to natural gas price volatility.

The latest natural gas price sensitivity analysis from MAKE, illustrated in Figure 1, underscores the significance of natural gas prices in the wind power outlook. The results indicate that the LCOE of new NGCC capacity is lower than wind power when natural gas prices do not exceed $5/MMBtu.

From 2015 to 2020, MAKE expects the LCOE of wind power to decline more than 10% following incremental reductions from technological advancements; gains in efficiency; and improved practices in siting, installation, and operations and maintenance.

This results in a lower break-even point between NGCC and wind power of roughly $4/MMBtu of natural gas – more than one-third higher than today's price of natural gas, yet lower than the average price in 2014.

Even with today's wind power costs and relatively low natural gas prices, investors considering an investment in new NGCC capacity with an operating life of 20 years or more should be wary of fuel price volatility. A renewable power asset with no fuel costs and more predictable returns presents an attractive option to hedge a portfolio against the future risk of volatile fuel prices.

The natural gas price sensitivity test based on MAKE's 2015 LCOE model incorporates the price of natural gas delivered to the NGCC plant, instead of prices at the Henry Hub. The delivered price fluctuates between 5% and 20% above the price at Henry Hub, at a 10% premium on average. In particular, the delivered price of natural gas to the power sector is where we expect to see the most acute price spikes, due to constraints in gas transmission and storage.

From the sensitivity analysis, MAKE concludes that the LCOE of unsubsidized wind power capacity will be increasingly competitive with NGCC capacity as natural gas prices increase. Given rising demand for natural gas, we expect to see an increase in natural gas prices on average. This inevitable rise in gas prices – in tandem with declining wind power costs – will begin to encourage additional wind power installations in the U.S. after 2017.

Ryan Moody is a North America market analyst at MAKE Consulting. He can be reached at rm@consultmake.com.