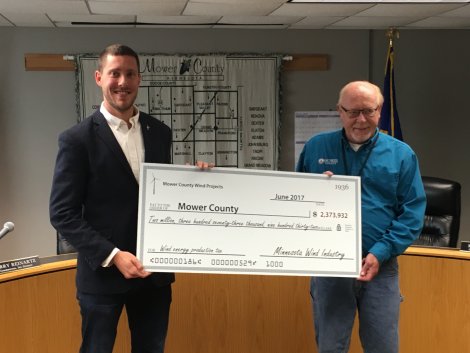

On Friday, representatives from the wind industry and Xcel Energy presented a ceremonial check to Tim Gabrielson, chairman of the Mower County, Minn., board of commissioners, for $2,373,932 in wind energy production tax revenue for 2016. According to Wind on the Wires, the check represents the largest wind energy production tax payment made to any one county in Minnesota. Moreover, it’s a 26.5% increase over last year’s payment.

Statewide, revenue from the wind energy production tax exceeds $12 million, and more than one-quarter of the counties in the state benefit from this source of revenue, says Wind on the Wires, a St. Paul, Minn.-based nonprofit organization that works to advance renewable energy in the Midwest.

“More wind energy is produced in our county than anywhere else in the state, and that has been a good thing for Mower County,” said Gabrielson. “Not only does this economic development benefit local landowners and businesses who have partnered in the wind projects – our entire community benefits from the production tax revenue received by our county. This last year, the county board committed $400,000 of the county portion of revenue from the wind energy production tax toward improving roads and bridges. We’ve used the remainder as a tax relief for citizens.”

“Minnesota is truly a leader in renewable energy in the Midwest, and Mower County is reaping the benefits of that leadership,” said State Sen. Dan Sparks. “The county has received over $14.8 million in wind energy production tax payments since 2007. That revenue helps our entire community because it helps keep the lid on property taxes, helps pay for road improvements and supports community projects. We need to continue supporting wind energy development in Minnesota.”

According to Wind on the Wires, the wind industry has invested $6.8 billion into Minnesota’s economy. With 3,499 megawatts of installed capacity, wind power now provides 17.7% of Minnesota’s electricity. In addition, another 906 MW of wind is under construction or is in advanced stages of development in Minnesota.

“Wind energy is a true success story for Minnesota, providing investment, revenue and jobs across the state” added Chris Kunkle, regional policy manager for Wind on the Wires. “The cost of wind energy has declined 66 percent over the past seven years, and utilities like Xcel Energy are passing those savings along to customers.

“This year, for the first time, the revenue from the wind energy production tax exceeds $12 million. Cumulatively, over the past 10 years, the wind industry has paid more than $78 million in production taxes. More than one-quarter of the counties in the state benefit from this revenue source, predominantly in Greater Minnesota where the jobs and economic development are needed most,” Kunkle said.