The wind industry saw strong funding and merger and acquisition (M&A) activity in the first quarter of this year (Q1'13), finds a new report from Mercom Capital Group LLC.

The wind industry saw strong funding and merger and acquisition (M&A) activity in the first quarter of this year (Q1'13), finds a new report from Mercom Capital Group LLC.

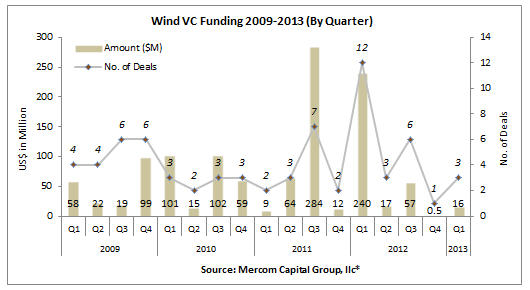

According to the report, wind sector venture capital (VC) funding rebounded in the first quarter, raising $16 million in three deals after the previous quarter saw just one $500,000 VC deal.

VC deals included Export Development Canada's $7 million financing of Endurance, a Vancouver-based manufacturer of wind turbines designed for power grid applications. Also receiving financing was Pentalum, a developer of a wind LIDAR system for remote sensing of wind, which raised $5.5 million from Bright Capital, Cedar Fund, Evergreen Venture Partners, ABB and Draper Fisher Jurvetson. Finally, Heartland Energy Solutions, a manufacturer of 100 kW wind turbines and blades, raised $3.9 million.

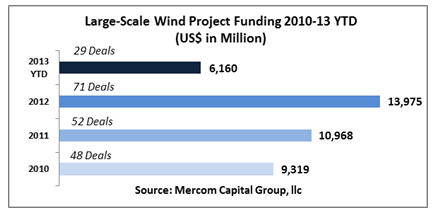

Mercom says most of the funding activity during Q1'13 went toward project funding, accounting for $6.2 billion in 29 deals. Large-scale onshore wind projects received over $3.42 billion in 26 deals, while offshore wind projects received over $2.74 billion in three deals. In the U.S., the Mercom adds, wind became the most installed energy generation source in 2012 and has continued that momentum in the first quarter of this year.

According to the report, the top-five large-scale projects funded in Q1'13 included $1.9 billion in project financing for wpd group's 288 MW Butendiek offshore wind project in Germany; $700 million in debt financing for Samsung Renewable Energy and Pattern Energy Group's 270 MW South Kent onshore wind project in Canada; a $664 million loan raised by EnBW Erneuerbare Energien for its 288 MW Baltic 2 offshore wind project from EIB; a $500 million investment received by Invenergy Wind for its 11 operating onshore wind projects in the U.S. and Canada from Caisse; and a $399 million investment received by EDF EN's Mexican unit, Eoliatec del Istmo, for its 164 MW Bii Stinu onshore wind project from Mitsui's subsidiary MIT Renewables Mexico and EDF Energies Nouvelles.

There were four M&A transactions in Q1'13, amounting to $543 million, out of which three were disclosed, the report adds.

The top M&A transaction in the first quarter was the acquisition of the Polish onshore wind business of Dong Energy, a company involved in procuring, producing, distributing and trading in energy and related products, by two Polish power utilities Polska Grupa Energetyczna (PGE) and Energa, for $314 million.

Mercom says there was strong project-acquisition activity this quarter, with 17 transactions amounting to $1.4 billion. The largest project M&A transaction by amount was U.K.-based renewable energy investor and developer Blue Energy's acquisition of the 177 MW RidgeWind portfolio from HgCapital for $392 million.

More information on Mercom Capital Group's report is available here.