According to newly released data from Advanced Energy Economy (AEE), the “advanced energy” industry was a $200 billion industry in the U.S. and a whopping $1.4 trillion industry globally as of the end of 2016.

AEE defines “advanced energy” as a “broad range of technologies, products and services that constitute the best available technologies for meeting energy needs today and tomorrow.”

The new report, which was prepared by Navigant Research for AEE, covers seven “advanced” segments: electricity generation, including wind and solar; fuel delivery; industry, including industrial combined heat and power and manufacturing machinery and process equipment; transportation; fuel production; electricity delivery and management, including transmission and energy storage; and building efficiency.

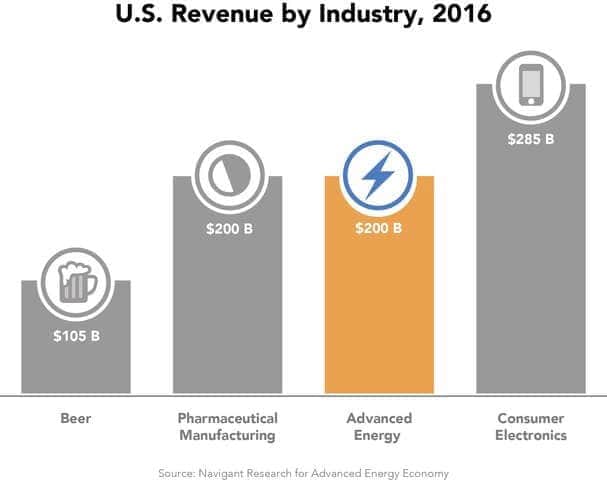

To put the numbers in perspective, U.S. advanced energy revenue for 2016 was nearly double that of the beer industry and equal to that of domestic pharmaceutical manufacturing – and it was even approaching revenue from wholesale consumer electronics, says AEE. As for global revenue, it was almost twice that of the airline industry and nearly equal to that of apparel.

“Over the past six years, the U.S. advanced energy market has grown a stunning 28 percent – with significant economic impact, now supporting more than 3 million jobs across the nation,” says Graham Richard, CEO of AEE.

According to the report, the largest segment of the U.S. advanced energy market was building efficiency, whose revenue grew by more than $5 billion in 2016 to a total of $68.8 billion.

According to the report, the largest segment of the U.S. advanced energy market was building efficiency, whose revenue grew by more than $5 billion in 2016 to a total of $68.8 billion.

U.S. power generation technologies were up 5% in revenue, led by solar, which capped off five years of growth with a 30% surge: a $5.7 billion increase to $24.9 billion in 2016, the report says.

U.S. wind revenue was relatively steady at $14.1 billion – a welcome change from the boom-and-bust pattern associated with the on-again, off-again federal production tax credit (PTC) earlier in the decade, AEE points out. With a five-year extension and phase-out of the PTC on the books, the development pipeline shows installations of between 8 GW and 9 GW of wind capacity annually from 2015 through 2018.

Energy storage also had another big year in the U.S.: Revenue jumped 54% to $427 million, the report says.

In transportation, sales of clean diesel vehicles were down sharply, dropping 45% for a decline of $2.7 billion in revenue – likely the result of Volkswagen’s emissions violations, according to AEE. However, revenue from plug-in electric vehicles (PEVs) rose nearly as much as clean diesel revenue fell – up $2.5 billion – for an increase of 48%. Under pressure from low gasoline prices, hybrid electric vehicles saw revenue fall for the third straight year – dropping 11% to $8.9 billion. If this trend continues, revenue from PEVs may surge past hybrid vehicles this year, the report notes.

“The AEE market report demonstrates growth in innovation, reduction in the cost of advanced energy, and investment in U.S. manufacturing and supply chains,” comments Paul Kaleta, AEE board member and chief legal counsel for First Solar Inc. “Electric generation and delivery markets are experiencing a period of rapid change.”

Another AEE board member, Dan’l Lewin, corporate vice president of technology and civic engagement for Microsoft, says, “Investing in clean energy helps us operate more sustainably and makes good business sense, especially as we continue to build a cloud for global good. And as today’s report confirms, these investments also create new jobs, support American businesses and help local and national economies. We’re pleased to play a part in supporting this important and growing industry sector.”

The full report from Navigant and AEE can be downloaded here.