While the debt supercommittee is enmeshed in – among other things – reforming the tax code, do not expect the group to issue a near-term verdict on individual tax credits, including the investment tax credit (ITC), a critical component to offshore wind development.

While the debt supercommittee is enmeshed in – among other things – reforming the tax code, do not expect the group to issue a near-term verdict on individual tax credits, including the investment tax credit (ITC), a critical component to offshore wind development.

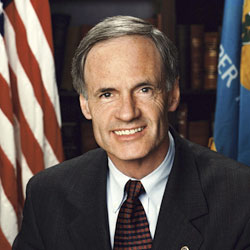

‘Although we expect [the supercommittee] to more broadly pick up tax reform, I do not expect them to report on individual tax credits,’ explained Sen. Thomas Carper, D-Del., who recently spoke with NAW about the prospects of passing S.B.1397: Incentivizing Offshore Wind Act, a bill he co-sponsored with Sen. Olympia Snowe, R-Maine.

The bill aims to provide the offshore wind industry with enhanced stability by extending ITCs for the first 3 GW of offshore wind facilities placed into service. Once a company is awarded a tax credit, it will have five years to install the offshore wind facility.

Carper said the likelihood of S.B.1397's passage of the legislation would occur ‘closer to the end of next year, rather than the beginning of it.’

As the bill's co-sponsor, Carper said he will continue to persuade Democratic Party leaders, such as Sen. Max Baucus, D-Mont., chairman of the Senate Committee on Finance and a member of the supercommittee. All tax legislation in the Senate runs through this committee.

‘As a co-sponsor, I have to be able to demonstrate the broad appeal [of renewable energy]," he said. ‘We'll be very persistent in encouraging Sen. Baucus to include these provisions. We'll be very persistent, but not obnoxious.’

One way to demonstrate such consensus is gaining further support from the private sector, Carper noted, citing Google's investment in the Atlantic Wind Connection, the proposed high-voltage direct-current offshore backbone that will enable the interconnection of up to 7 GW of offshore wind power produced off the coasts of several Mid-Atlantic states.

While a companion bill calling for extensions of offshore wind incentives was recently introduced in the House, it remains uncertain whether legislators will garner enough support to extend the tax incentives.

Additionally, there is the larger issue of which tax incentives the wind industry should be advocating. Both the production tax credit (PTC), which has generally been favored for land-based wind, and the ITC, which has been more prominently used for offshore wind projects, are set to expire at the end of 2012.

The PTC provides a tax credit of $0.022/kWh for the production of electricity from utility-scale wind turbines. The ITC, meanwhile, allows PTC-qualified wind facilities installed between 2009 and 2012 to elect for a 30% ITC in lieu of the PTC. If the ITC is chosen, the election is irrevocable and requires the depreciable basis of the property to be reduced by one-half the amount of the ITC.

Carper urged the wind industry to advocate for the extension of both tax incentives. In doing so, he said, the industry could benefit from a broad geographic coalition of those who support land-based wind power in places such as California, Texas and the Midwest, in addition to those along the Eastern Seaboard who advocate for offshore wind.

‘If you marry the two together, that's a pretty broad coalition – potentially, a very potent one,’ he said, adding that onshore and offshore wind ‘would not exactly be strange bedfellows.’

In fact, provisions for PTC and ITC extensions could be contained in the same bill, Carper added.

Carper said he expects a Bureau of Ocean Energy Management ruling on the issuance of commercial lease blocks available off the coast of Delaware by the end of this year. The lease-block issuances, part of the Department of the Interior's Smart from the Start program, are also expected for New Jersey, Maryland and Virginia.

Carper cautioned that he – and co-sponsor Snowe – must be re-elected next year for offshore wind to continue to be advocated.

‘It's very much a political game,’ he said. ‘If people like what we're doing, then we'll ride the wind to victory.’