As more and more Fortune 500 companies emerge as major customers of U.S. clean energy, a new report from the American Wind Energy Association (AWEA) is revealing exactly what, where and how they are buying renewable power.

Over the last four years, says AWEA, Fortune 500 companies have awakened to the potential of purchasing renewable energy. Recently, major corporate renewables announcements have flooded in: For example, Google announced it will run entirely on renewable energy in 2017; moreover, 95% of that will come from wind.

In addition, General Motors will use wind to power a Texas factory that makes 1,200 SUVs per day, such as the Tahoe and Escalade. Also, last year, Mars Inc., aiming to eliminate all fossil fuel use from its operations by 2040, opened a Texas wind farm, which now generates the equivalent of 100% of the electricity needed to power the company’s U.S. operations.

“In recent years, Fortune 500 companies have led an intense search for the best ways to buy more clean energy,” states Tom Kiernan, AWEA’s CEO. “And when big-name brands buy clean energy, they overwhelmingly choose wind because of our reliable, low cost. Survey after survey shows Americans want more wind, and we want them to know brands behind the well-known products they buy – Amazon, General Motors, Google, Walmart and many more – are already wind-powered.”

AWEA’s new report, “Evolution of the Corporate Wind PPA: Market Insights,” looks behind the recent headlines. The report shows how America’s big brands are powering their business with wind and, in turn, publishing never-before-collected details on corporate power purchase agreements (PPA).

The report shows how America’s big brands are powering their business with wind and, in turn, publishing never-before-collected details on corporate power purchase agreements (PPA).

Specifically, AWEA researchers surveyed 23 companies who have signed PPAs to power their business.

“Wind power is the energy source of choice among these companies by a factor of six to one,” notes Hannah Hunt, lead author of the report and senior analyst for AWEA.

According to AWEA’s report, companies have procured approximately 5,000 MW of wind through PPAs (out of a total 6,002 MW purchased from specific wind projects). The remaining 1,002 MW was acquired through direct ownership or by other means.

In total, through PPAs and other methods, corporate customers have acquired 6,002 MW of wind and around 1,000 MW of solar through November of this year, the report adds.

“Members of the Fortune 500 know how to get results, and they have applied that mentality to clean energy,” adds Hunt. “We now know how and where they have gone about buying 5,000 MW of wind power through PPAs.

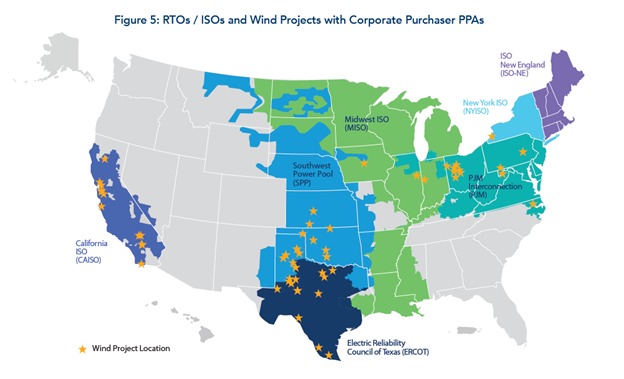

“The bulk of wind projects built to serve the Fortune 500 are located from Texas, up through the rural heartland and across the Rust Belt,” she says. “That’s where some of the best wind resources are. It also happens to be part of the country hurting for jobs and private investment.”

“When these companies invest in a wind farm, they invest in a community. For example, when Iron Mountain brought a data center to southern Pennsylvania, they also invested in a wind farm in the state – that’s two multi-million-dollar boosts into the Rust Belt economy where previously there was one.”

Generally speaking, AWEA points out, companies need a lot of energy to power their retail stores, manufacturing facilities and data centers. Roughly 80% of wind capacity purchased by corporate customers is located in the same electricity market where at least some of the companies’ demand comes from, according to the report.

“American companies aren’t standing by waiting for clean, cost-effective energy,” Hunt concludes. “They have applied market-leading innovation to develop new financial tools – including virtual power purchase agreements – that get projects built where they otherwise might not be.”

In addition, AWEA’s research finds that many corporate customers are moving from traditional PPAs, where energy is delivered directly along power lines, to virtual PPAs, which are financial transactions.

In turn, AWEA says, this flexibility allows companies to invest in wind and other clean energy projects in parts of the country where they wouldn’t have been able to do so before due to regulatory limits.

More on the report can be found here.