Global funding in the wind sector totaled $10.5 billion in the first quarter of this year (Q1'14), up from $7.9 billion in Q4'13, according to a new report from Mercom Capital Group. This includes venture capital (VC) funding, public market financing, debt financing and announced project funding deals.

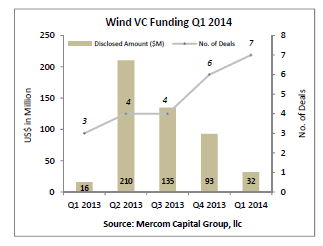

Wind VC funding fell to $32 million compared to $93 million in Q4'13. The report says the largest VC deal was by 3sun Group, a company that installs and maintains offshore wind turbines, which raised $16.7 million from Business Growth Fund.

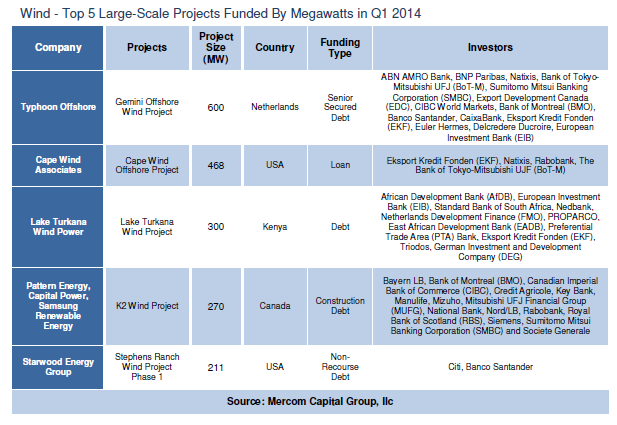

Announced large-scale project funding in Q1'14 jumped to $7.2 billion in 29 deals compared to $4.9 billion in 32 deals in Q4'13. Mercom says this boost is due to a number of offshore wind deals, and there were a total of 20 investors that participated in multiple project funding agreements this quarter.

Mercom also tracked more than 12 GW of new project announcements globally this quarter in various stages of development. The top project funding agreement was the $1.47 billion received by Typhoon Offshore for its 600 MW project.

According to the report, there were also six merger and acquisition (M&A) transactions in Q1'14, one of which disclosed amounts totaling $419 million.

Project acquisitions in the first quarter totaled $3.8 billion compared to $2 billion in Q4'13. Mercom says the top five largest project acquisitions by disclosed amount were led by the investment group La Caisse, which purchased a 25% share of the 630 MW London Array 1 wind project for $1.1 billion.

That was followed by Brookfield Renewable Energy Partners' purchase of the 321 MW Bord Gais Energy wind project portfolio for $960 million; Green Investment Bank and Marubeni Corp.'s 50% stake in the 210 MW Westermost Rough offshore wind project for $832 million; Copenhagen Infrastructure Partners' purchase of a 67% economic stake in a 900 MW offshore grid connection for wind projects for $526 million; and the Green Investment Bank's purchase of a 10% stake in the 576 MW Gwynt y Mor offshore wind project for $366 million.

Of the disclosed project acquisitions in Q1'14, Mercom says there were nine project developers that acquired wind projects, 10 investment funds, two independent power producers and two utilities.

More information about the report is available here.