Last year, total global funding into the wind sector reached $28.1 billion, according to a new report from Mercom Capital Group. This includes venture capital (VC) funding, public market financings, debt financings and announced project funding deals.

Last year, total global funding into the wind sector reached $28.1 billion, according to a new report from Mercom Capital Group. This includes venture capital (VC) funding, public market financings, debt financings and announced project funding deals.

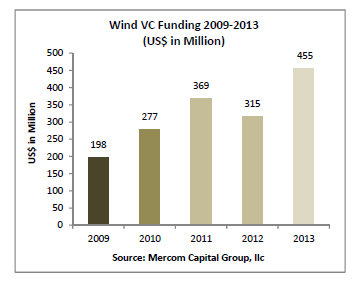

The report says VC funding increased to $455 million in 2013, compared to $315 million in 2012. In the fourth quarter, such funding came to $93 million in six deals, compared to $135 million in four deals the previous quarter.

According to Mercom, there were seven downstream companies that raised a combined $374.3 million in 2013. Six small wind turbine manufacturers raised $68.8 million, one wind component company raised $6.2 million and three monitoring software companies raised $5.5 million.

The report says the top VC-funded company in 2013 was ReNew Power, an Indian wind project developer, which raised $135 million, followed by Mainstream Renewable Power, an independent renewable energy project developer, which raised $133 million. NSL Renewable Power, also a project developer from India, raised $60 million, and Ogin (formerly FloDesign), a manufacturer of small wind turbines, raised $55 million. Green Infra, a renewable power producer from India, raised $25 million.

Public market financings accounted for $5.8 billion in 17 deals in 2013, including six initial public offerings (IPOs) totaling $2.3 billion.

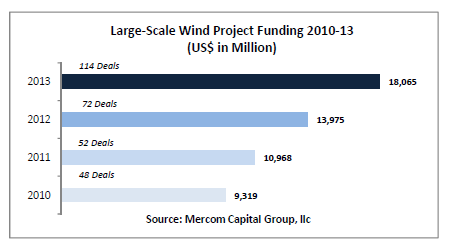

The report adds that announced large-scale project funding in 2013 amounted to $18.1 billion in 114 deals, compared to $14 billion in 72 deals in 2012. There were a total of 150 investors that participated in project funding last year. Mercom says the most active project funding investors were KfW IPEX-Bank with nine deals, followed by the European Investment Bank with seven deals, and Nord/LB with six deals. Announced large-scale project funding in the fourth quarter ($4.9 billion in 32 deals) increased compared to the third quarter ($3.9 billion in 21 deals).

According to the report, the fourth quarter was very active for large-scale project development activity around the world. Mercom tracked about 104 project announcements totaling almost 10.7 GW in various stages of development.

In addition, the company says 2013 was a strong year for mergers and acquisitions (M&A) activity in the wind sector, with 33 transactions, 18 of which were disclosed for a combined $2.6 billion. By comparison, 2012 saw 35 transactions.

Of the 33 M&A transactions in 2013, the report says wind downstream companies accounted for 20 of them, wind component companies accounted for six, service providers and manufacturers accounted for three each, and balance-of-system companies accounted for one transaction.

Mercom says the top M&A transaction in 2013 was the $1.25 billion acquisition of Kaydon Corp., an industrial manufacturer and supplier of wind turbine bearings, by SKF Group, a global supplier of bearings, seals, mechatronics, lubrication systems, and other services.

This was followed by the acquisition of the Polish onshore wind business of DONG Energy, a company involved in procuring, producing, distributing and trading in energy and related products, by two Polish power utilities – Polska Grupa Energetyczna and Energa – for $314 million.

Brookfield Renewable Energy Partners, an operator of pure-play renewable power platforms, acquired vertically integrated renewable energy production company Western Wind Energy for $182 million. Private-equity firm Actis acquired 60% of Atlantic Energias Renovaveis, a Brazilian renewable energy company, for an initial commitment of $169 million. Rounding out the top five transactions was the acquisition of wind energy developer Salus Fundos de Investimento em Participacoes by Brazilian utility Copel for about $128 million, the report adds.

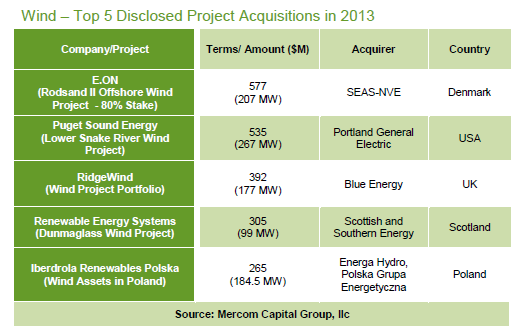

Disclosed project acquisitions increased in 2013, with 116 transactions – compared to 72 transactions in 2012 – representing over 16 GW that changed hands. There were 37 project acquisitions in the fourth quarter compared to 26 in the third.

The report says the top five large-scale wind project acquisitions in 2013 included the $577 million acquisition by SEAS-NVE of an 80% stake in the 207 MW Rodsand II offshore wind project from E.ON; Portland General Electric's acquisition of Puget Sound Energy's 267 MW Lower Snake River Phase II Wind Project for $535 million; Blue Energy's acquisition of the 177 MW RidgeWind portfolio from HgCapital for $392 million; Scottish and Southern Energy's acquisition of the 99 MW Dunmaglass Wind Project from Renewable Energy Systems for $305 million; and Iberdrola Renewables Polska's sale of 184.5 MW of wind projects to Polish companies Energa Hydro and Polska Grupa Energetyczna for $265 million.

Announced debt financing amounted to $3.8 billion in 10 deals in 2013, compared with $12.5 billion in 16 deals in 2012, the report continues. There were 34 new cleantech and wind-related funds announced in 2013 – 14 were announced in the fourth quarter.