Algonquin Power & Utilities Corp.’s (AQN) indirect subsidiary, Liberty Utilities Co., has entered into an agreement with American Electric Power (AEP) to acquire Kentucky Power Co. and AEP Kentucky Transmission Co. Inc. (Kentucky TransCo) for a total purchase price of approximately $2.846 billion.

Kentucky Power is a state-regulated electricity generation, distribution and transmission utility operating within the Commonwealth of Kentucky, serving approximately 228,000 active customer connections and operating under a cost-of-service framework. Kentucky TransCo is an electricity transmission business operating in the Kentucky portion of the transmission infrastructure that is part of the Pennsylvania – New Jersey – Maryland regional transmission organization (PJM). Kentucky Power and Kentucky TransCo are both regulated by the U.S. Federal Energy Regulatory Commission (FERC).

“The acquisition of Kentucky Power and Kentucky TransCo is a continuation of AQN’s disciplined growth strategy, adding to its regulated footprint in the United States,” comments Arun Banskota, president and CEO of AQN. “Kentucky Power offers an opportunity for AQN to utilize its ‘greening the fleet’ capabilities in a complementary and constructive jurisdiction.”

Kentucky Power currently operates two regulated electricity generation facilities (the Mitchell coal generating facility in West Virginia and the Big Sandy natural gas generating facility in Kentucky), and procures electricity under a unit power agreement (UPA) with the Rockport coal generating facility as well as through market purchases in PJM. In separate filings, Kentucky Power and AEP’s Wheeling Power subsidiary plan to seek regulatory approval to transfer operational control of Mitchell Plant to Wheeling Power and set up Kentucky Power’s exit from the plant in 2028.

To support the expiry of the Rockport UPA in 2022 and the expected transfer or retirement of Kentucky Power’s 50% ownership interest (representing 780 MW) in the Mitchell facility in 2028, Kentucky Power is expected to have the opportunity to replace these fossil fuel generation sources with renewable generation.

The company has significant experience in “greening” fleets of regulated fossil fuel generation. In 2017, AQN completed the acquisition of The Empire District Electric Company and recently completed a $1.1 billion investment in 600 MW of wind generation to support Empire’s service territory, which included the early retirement of the Asbury Coal Plant. Similarly, at CalPeco, AQN’s electricity utility in California, the company has implemented similar initiatives, investing approximately $132 million in the addition of two utility-scale solar generation facilities in order to provide clean energy for its California customers.

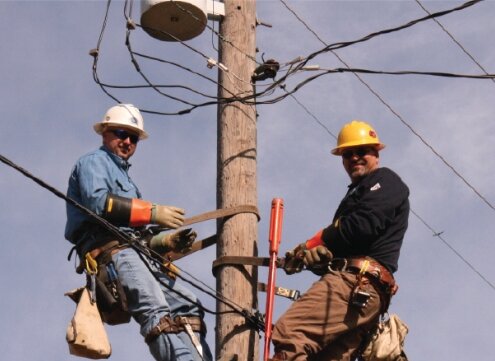

Image: Electrical lineworkers for Algonquin Power & Utilities Corp.