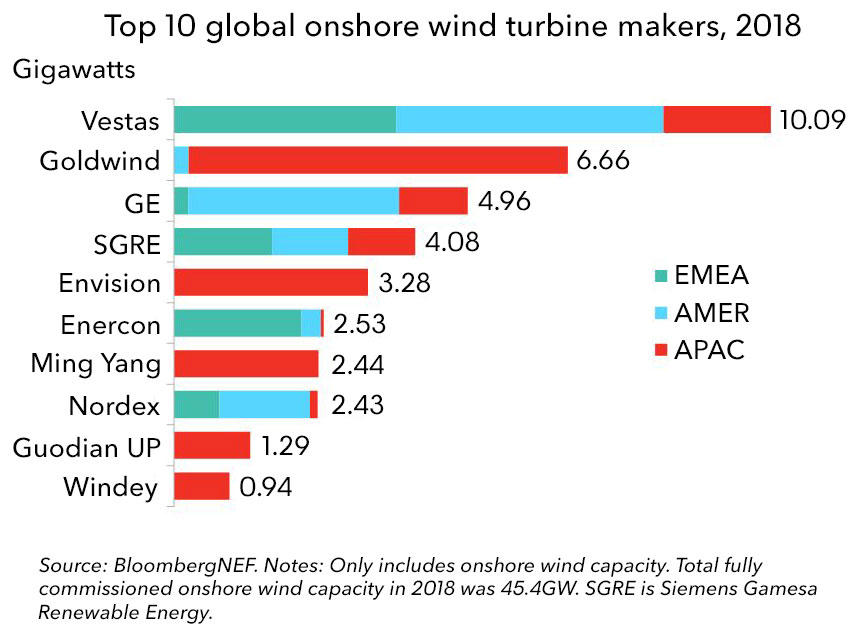

Developers commissioned a little over 45 GW of onshore wind turbines globally in 2018, compared with 47 GW in 2017, according to new findings from BloombergNEF. Notably, just four manufacturers accounted for more than half, or 57%, of the machines deployed: Denmark’s Vestas, China’s Goldwind, the U.S.’ GE Renewable Energy and Spain’s Siemens Gamesa.

The latest numbers from BNEF show that Vestas extended its lead in the industry, with 10.1 GW of its onshore turbines commissioned in 2018 – representing a global market share of 22%, compared with 16% in 2017.

Goldwind rose from third to second place in 2018, lifted by a strong performance in China, where it captured a third of the 19.3 GW market. The company’s global footprint, however, remains limited: Only 5% of Goldwind’s 6.7 GW was commissioned outside of China.

GE came in third with 5 GW, and six out of every 10 GE turbines were commissioned in the U.S. Both GE and Vestas commissioned just over 3 GW in the U.S., with Vestas leading by only 44 MW in the neck-to-neck race for U.S. market leadership.

Siemens Gamesa, formed in 2016 from a merger of the wind business of German engineering giant Siemens and Spanish turbine maker Gamesa, dropped from second to fourth place, with 4.1 GW commissioned in 2018. This represents a 40% drop from 2017, although the tally does not include a number of very large wind farms that are only partially built and will not come online until this year, notes BNEF.

“Chinese manufacturers rely almost solely on their home market,” states Tom Harries, senior wind analyst at BNEF and lead author of the report, Global Wind Turbine Market Shares. “Of the European onshore wind turbine makers to make the top 10, Vestas and Nordex actually commissioned more capacity in the Americas than in Europe. Most of Enercon’s turbines are in Europe. Siemens Gamesa is the most diversified, with a near equal split across Europe, the Americas and Asia.”

He continues, “In offshore wind, it’s been a record year for China, and we will see more growth. Some 1.7 GW of the global 4.3 GW was commissioned there. In Europe, it was a tight race between Siemens Gamesa and MHI Vestas. GE has some projects coming up in France, and we also expect to see orders for their new 12 MW platform.”

Total onshore wind installations in 2018 were 11.7 GW in the Americas, 8.5 GW in Europe (including Turkey and Russia), and 1 GW in Africa and the Middle East, while Asia accounted for 24.2 GW. BNEF registered new wind farms starting full commercial operation in 53 countries.

David Hostert, head of wind research at BNEF, remarks, “Last year was a bit of a mixed picture in terms of global onshore wind installations, with only 45.4 GW commissioned. Still, add to that 4.3 GW offshore wind, and 2018 ended slightly lower than 2017. Now it is time for the manufacturers to buckle up for two stormy years ahead: We predict demand for around 60 GW of onshore capacity in both 2019 and 2020 with increases in all regions.

“However, a lot of this impressive-sounding volume rides on extremely competitive pricing, add-on products and services, and new financing models,” he says. “This will be tough to deliver for the ‘Big Four,’ let alone the smaller turbine makers.”