Global capacity and investment for offshore wind set records in 2020, according to research from The Renewables Consulting Group (RCG), a specialized services firm that supports the global renewable energy sector.

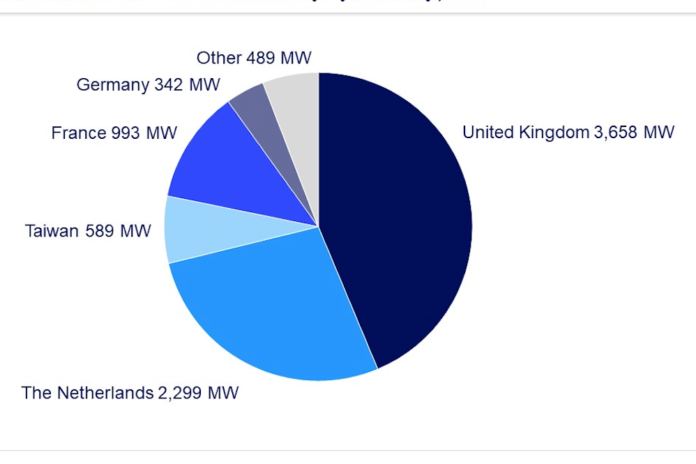

According to RCG’s Global Renewable Infrastructure Projects (GRIP) database, the total capacity for offshore wind last year reached 8,370 MW across the European, Americas and Asia Pacific regions, eclipsing the previous total of 6,438 MW installed in 2018. Global investment for offshore wind also set new highs last year as investment reached $30 billion, surpassing the previous high of $22 billion set in 2018.

“Global offshore wind continues its extraordinary growth,” says Maxwell Clarke, an associate in RCG’s market intelligence team. “Despite the pandemic, 2020 saw more offshore wind capacity and investment than any year before. Across global markets, record capacity investments were not only seen in firm commitments to build projects but also in capacity acquired through mergers and acquisitions.”

Several notable offshore wind projects, such as Dogger Bank A&B, the world’s largest offshore wind project, reached their final investment decisions (FID) in 2020. The FID – the point where major equipment orders are placed and contracts executed for the engineering, procurement and construction stage – signifies that developers, owners and operators have made a firm commitment to move forward with the project.

Each country where offshore wind projects attained the FID milestone – the U.K., France, Netherlands, Germany and Taiwan – utilized some type of framework agreement such as the U.K.’s contracts for differences or the feed-in-tariff (FiT) model used in Taiwan and China.

The U.K. saw more than 3,658 MW in capacity secured investment with 2,950 MW supported by the contracts for difference (CFD) mechanism. In the Netherlands, the centrally planned and developed Hollandse Kust Zuid and Hollandse Kust Noord sites were advanced through the subsidy-free tendering mechanism – allocating a combined 2,299 MW in capacity.

China’s offshore wind market – which is slated to surpass the U.K. as the leading global market in operational capacity by the end of this year – experienced unprecedented growth and project deployment last year. In 2019 the Chinese market introduced price-based offshore wind tenders and announced that the FiT rate for projects consented in future tenders would be phased out for 2022, requiring bid prices to compete with wholesale market rates from then on.

In order to qualify for the soon-to-expire FiT, projects successful in lease auctions since 2019 must commission the site by the end of 2021 – resulting in a massive development rush that has seen over 5 GW of new capacity come online in 2020, with over 10 GW at various stages of construction.

While emerging markets have seen unprecedented growth in 2020, in terms of new project announcements and portfolio development, firm investment to take projects forward still requires a reduction in relative asset risk. In 2020 and early 2021, this need for project de-risking has been recognized in Greece, Sweden, Brazil, Romania and Bulgaria, with respective governments openly exploring offshore wind frameworks and incentivizing forward market growth.