A new study from Lawrence Berkeley National Laboratory finds that the market value of offshore wind – considering energy, capacity and renewable energy certificates (RECs) – varies significantly along the U.S. east coast and generally exceeds that of land-based wind in the region.

The new Berkeley Lab study, funded by the U.S. Department of Energy, unpacks various value components and explores a hypothetical question: What would the marginal economic value of offshore wind projects along the east coast have been from 2007 to 2016, had any such projects been operating during that time period?

Berkeley Lab researchers answer this question by developing an approach based on historical weather data at thousands of potential offshore wind sites, combined with historical wholesale market outcomes and REC prices at hundreds of possible locations. The study’s focus on the value of offshore wind complements the large body of literature that has analyzed the cost of offshore wind.

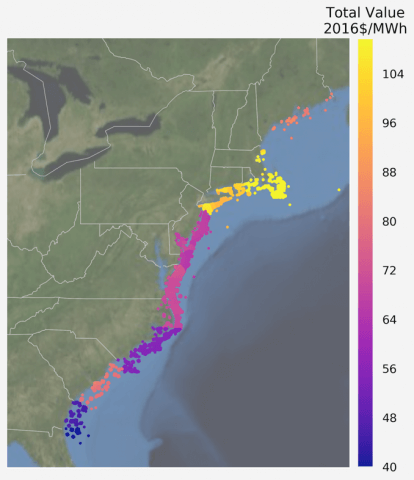

The study finds that the historical market value of offshore wind (energy, capacity and REC value) is highest for sites off of New York, Connecticut, Rhode Island and Massachusetts and lowest for sites along the southeastern coast:

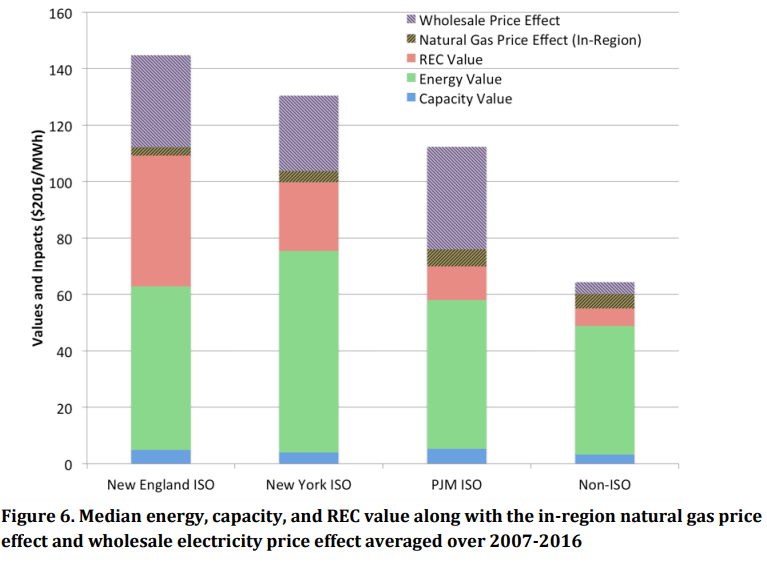

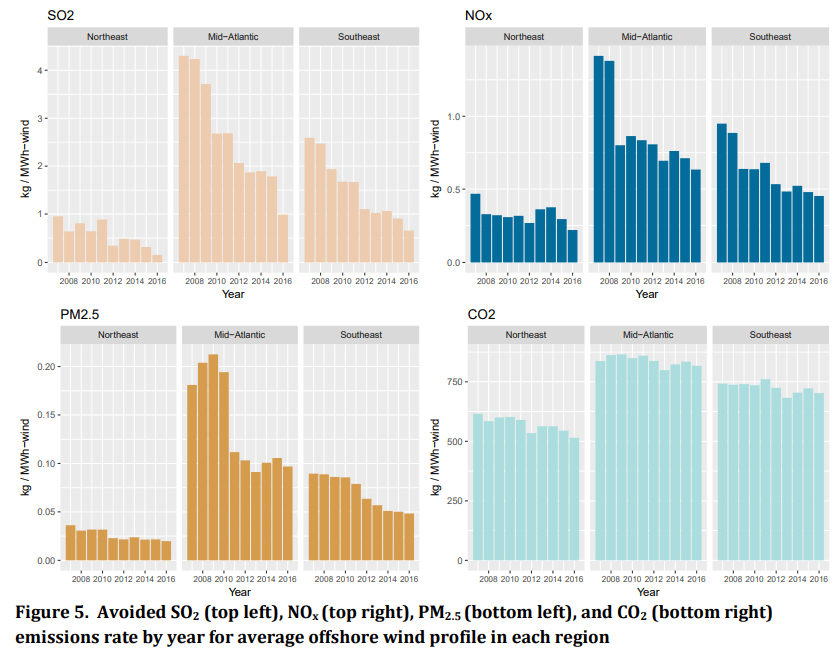

The analysis also finds that offshore wind can reduce air pollution emissions and wholesale electricity and natural gas prices, though effects vary in magnitude over time and across regions:

According to the study, the market value of offshore wind is found to have exceeded that of land-based wind, thanks to offshore wind’s locations closer to major population centers and its time-varying profile of electricity production that is more correlated with that of electricity demand.

Yet, the study says, the cost of offshore wind is higher than that of land-based wind, thus requiring important economic trade-offs. Cost reductions that approximate those witnessed recently in Europe may be needed for U.S. offshore wind to offer a credible long-term economic value proposition on a widespread basis along the eastern seaboard, says Berkeley Lab.

Finally, the research discusses how the various value components might change in the future, and it assesses multiple ways to potentially enhance the value of offshore wind, including by varying the location of grid interconnection and adding electrical storage.

Knowing how the historical value of offshore wind has varied both geographically and over time – and what has driven that variation – can provide important insights to a variety of stakeholders, including offshore wind developers and purchasers, as well as energy system decision-makers, the report points out. In addition, focusing on market value may help to inform the U.S. Department of Energy on its offshore wind technology cost targets, as well as the early-stage research and development investments necessary to reach them.

A 12-page executive summary, accompanied by a more detailed slide deck that explains the study, can be downloaded here. A free webinar to summarize the key results will also be offered on April 26 at 3:00 p.m. EST.

Charts courtesy of Berkeley Lab