According to new findings from BloombergNEF, corporations globally bought a record amount of clean energy through power purchase agreements (PPAs) in 2018, shattering the previous record set in 2017.

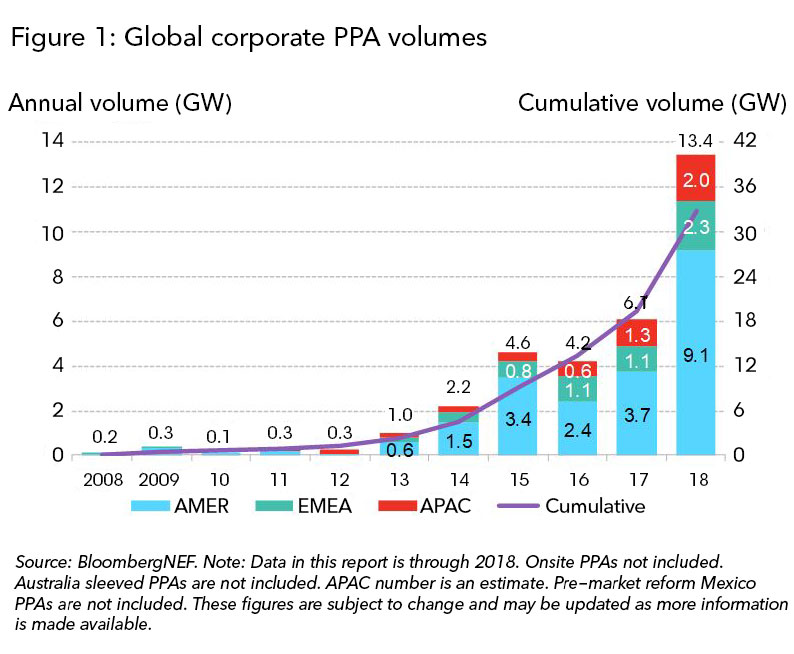

BNEF’s “1H 2019 Corporate Energy Market Outlook” shows that some 13.4 GW of clean energy contracts were signed by 121 corporations in 21 different countries in 2018 – up from 6.1 GW in 2017. According to BNEF, this positions companies alongside utilities as the biggest buyers of clean energy globally.

“Corporations have signed contracts to purchase over 32 GW of clean power since 2008, an amount comparable to the generation capacity of the Netherlands, with 86 percent of this activity coming since 2015 and more than 40 percent in 2018 alone,” says Jonas Rooze, BNEF’s head of corporate sustainability.

More than 60% of the global activity in 2018 occurred in the U.S., where companies signed PPAs to purchase 8.5 GW of clean energy, representing nearly triple the amount signed in 2017. Facebook spearheaded a contingent of experienced U.S. corporate energy buyers, purchasing over 2.6 GW of renewables globally in 2018, primarily with utilities in regulated U.S. markets through green tariffs. This was three times that of the next biggest corporate energy buyer, AT&T, says BNEF.

ExxonMobil became the first oil major to sign a clean energy PPA for its own operations, purchasing solar and wind in Texas. Mexico and Brazil also saw growth in corporate procurement, rounding out the 9.1 GW of clean energy purchased by companies in the Americas region in 2018.

In the U.S., a major feature was the emergence of smaller, first-time corporate clean energy buyers. In 2018, some 34 new companies signed their first clean energy PPAs, making up 31% of total activity in the U.S. These firms are aggregating their electricity demand to reap the economies of scale from larger solar and wind projects, notes BNEF. In many cases, they benefit from partnering with a bigger, more experienced buyer – an anchor tenant – that can offer a stronger balance sheet and expertise on accounting and legal nuances for signing a PPA.

Kyle Harrison, a corporate sustainability analyst for BNEF and lead author of the report, says, “The aggregation model has heralded in a new generation of corporate clean energy buyers. These companies no longer need to tackle the complexities of clean energy procurement alone. They can share risks associated with credit and energy market volatility with their peers.”

In the Europe, Middle East and Africa region, corporations also purchased record volumes of clean energy, inking deals for 2.3 GW and doubling the 1.1 GW signed in 2017. The Nordics were, once again, the hot spot for activity, with companies attracted to strong wind resources and credit support from government bodies.

Several European countries that saw little or no corporate procurement activity in 2017 enjoyed a rise in interest in 2018. Companies signed PPAs for the first time in Poland, and just the second time in Denmark and Finland. There were also new deals signed in the U.K., following a lull after the expiration of a national subsidy program. Several requests for proposals and changes in policy suggest burgeoning new markets in Germany and France, as well, according to BNEF.

In the Asia-Pacific region, still a nascent market for corporate procurement, companies signed a record 2 GW of clean energy PPAs, more than the previous two years combined. Nearly all of this activity occurred in India and Australia, with roughly 1.3 GW and 0.7 GW of clean energy purchased, respectively. Both markets allow companies to buy clean energy at a large scale through off-site PPAs, making them rarities for the region, BNEF points out.

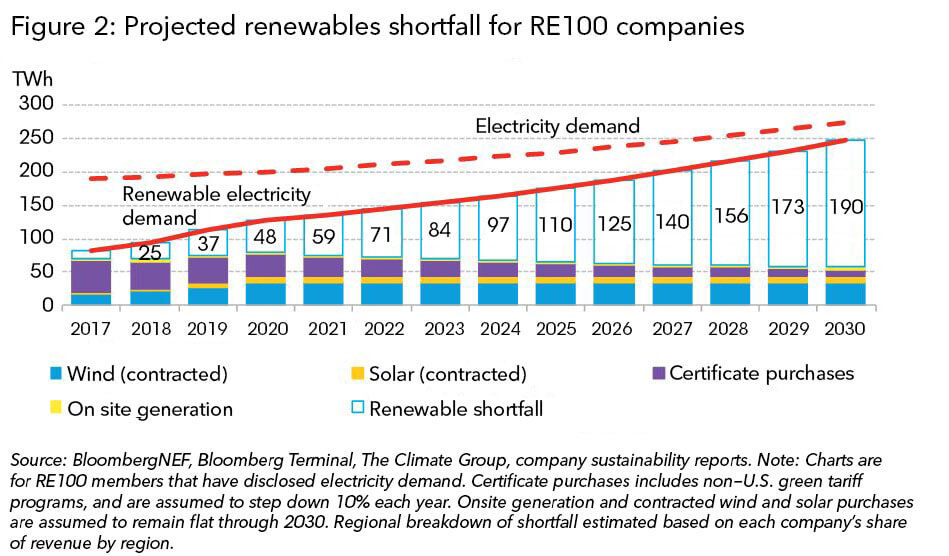

According to the report, the healthiest signal of continued growth in the global corporate procurement space is the growing alliance of companies establishing clean energy and sustainability commitments. For example, the RE100 campaign – consisting of nearly 160 signatories, as of the end of 2018, that have established 100% renewable electricity targets – has companies domiciled in 23 different markets. Cumulatively, these companies consumed an estimated 189 TWh of electricity in 2017, equivalent to Egypt’s electricity consumption, says BNEF.

BNEF estimates these companies will need to purchase an additional 190 TWh of clean electricity in 2030 to meet their RE100 targets. Should this shortfall be met with off-site solar and wind PPAs, it would catalyze an estimated 102 GW of new solar and wind build globally – greater than the size of the U.K.’s power generation fleet in 2017.

Rooze adds, “For companies that think seriously about sustainable growth, establishing clean energy and decarbonization targets lines up naturally with overall corporate strategies. At the same time, these initiatives have created an entire new universe of opportunity for utilities, clean energy developers and investors.”