With a combined capacity of 50,617 MW, there were 20,641 wind turbines installed globally by 37 manufacturers in 2018, according to a new report from the Global Wind Energy Council (GWEC).

In its “Global Wind Market Development – Supply Side Data 2018” report, GWEC finds that over half of the top 15 wind turbine manufacturers are based in China.

Vestas held the title as the world’s largest turbine supplier in 2018, due to its wide geographic diversification strategy and strong performance in the Americas, the report says. In fact, one in five wind turbines was installed by Vestas.

Goldwind moved up one position to second place after its domestic market share increased by 5.1% in 2018. Siemens Gamesa fell one position to third place, primarily due to lower installation numbers in the U.K., Germany and India in 2018, according to the report.

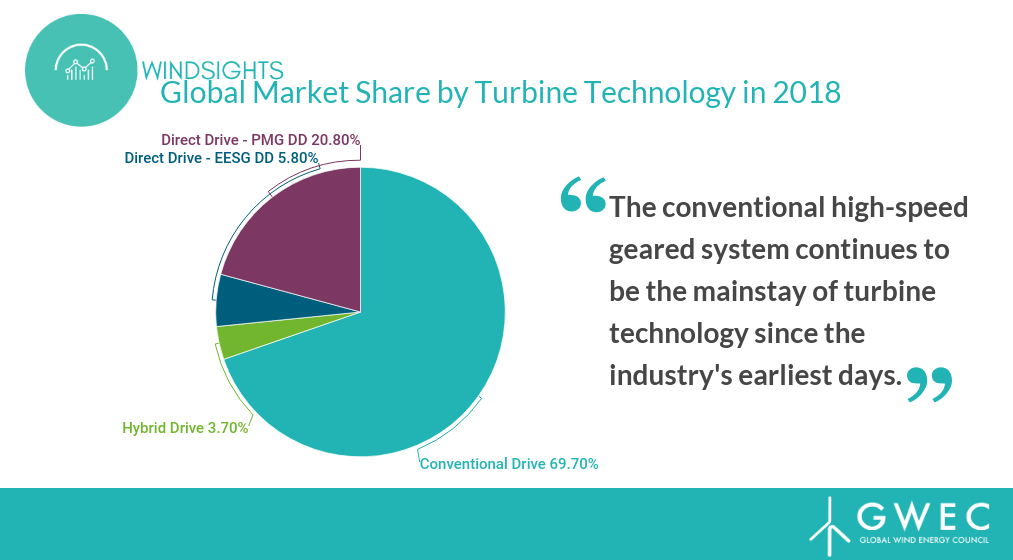

The report shows that geared wind turbine systems remain the preferred choice of wind turbine technology: The market share of conventional high-speed geared systems and medium-speed turbines increased to 69.7% and 3.7%, respectively, in 2018, while the market share of direct-drive wind turbines dropped nearly 2% to 26.6% in 2018, primarily due to the reduction of wind turbines installed by Germany’s Enercon in 2018.

The No. 1 suppliers in each of the three technology categories (high-speed geared drive, medium-speed geared drive and direct-drive) in 2018 were Vestas, Mingyang and Goldwind, respectively.

“The fact that tier one suppliers gained greater market share in a year when the new installation declined by three percent reinforces that leading global suppliers’ hard work, focusing on product innovation and value-added solutions, has finally paid off,” comments Ben Backwell, CEO of GWEC.

“While there are eight Chinese manufacturers included in the top 15, the picture changes dramatically when sales in the domestic Chinese market are excluded,” he continues. “Aside from Goldwind, none of the Chinese suppliers installed sufficient new wind capacity in the overseas market for any to be included in the top 10 ranking in 2018.”

Feng Zhao, strategy director of GWEC, adds, “In 2018, we saw further consolidation taking place on the supply side. The severe competition resulting from the transition from feed-in tariff to auctions pushed another seven small turbine OEMs out of the market last year. This trend is likely to continue in China; although there are 19 local turbine OEMs active in this country, the upcoming auction and the central government’s goal to reach grid parity in the early 2020s will certainly force many small and medium-sized Chinese turbine vendors to give up their wind turbine production activities.”

GE Renewable Energy retained fourth place by taking advantage of stronger performance in the U.S. market, where it recaptured the title as the No. 1 supplier, according to the report. Envision replaced Enercon in fifth place, mainly due to Envision’s strong growth in China and the sharp drop in installations in Enercon’s domestic German market in 2018.

Chinese suppliers Mingyang, United Power and Sewind moved up to seventh, ninth and 10th, respectively, which can be largely attributed to stable performances in their home markets. Suzlon dropped out of the top 10 turbine supplier ranking in 2018, primarily as a result of reduced installations – by up to one-third – in its home market of India.

Senvion fell three positions to 12th, with new installations in Germany in 2018 halving compared to the previous year. Chinese suppliers CSIC Haizhuang and XEMC remained in the top 15; however, both of them lost market share in 2018.

The full report is available for GWEC members here.