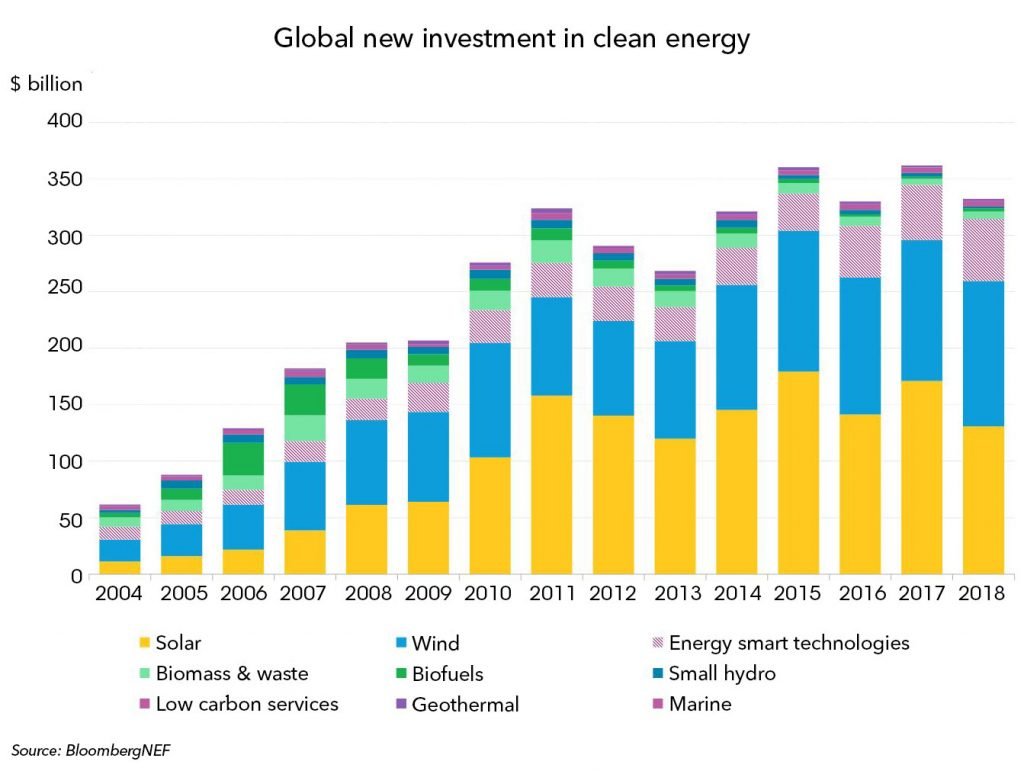

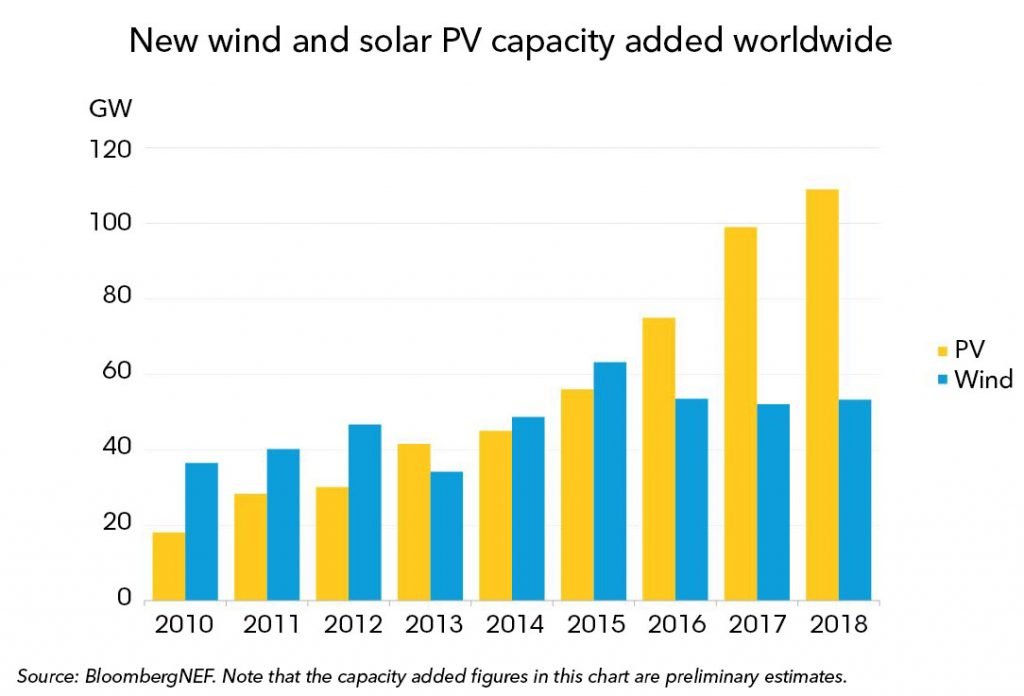

Global clean energy investment totaled $332.1 billion in 2018, which was down 8% on 2017, according to authoritative figures from research company BloombergNEF (BNEF). Although solar commitments declined in dollar terms, there was record new photovoltaic capacity added, breaking the 100 GW barrier for the first time.

Last year was the fifth in a row in which investment exceeded the $300 billion mark, says BNEF, which notes that investment in renewable energy excludes large hydro-electric projects but includes equity-raising by companies in smart grid, digital energy, energy storage and electric vehicles (EVs).

There were sharp contrasts between clean energy sectors in terms of the change in dollar investment last year. Wind investment rose 3% to $128.6 billion, with offshore wind having its second-highest year. Money committed to smart meter rollouts and EV company financings also increased.

However, the most striking shifts were in solar, according to BNEF. Overall investment in that sector dropped 24% to $130.8 billion, partly due to sharply declining capital costs. BNEF’s global benchmark for the cost of installing 1 MW of photovoltaic capacity fell 12% in 2018 as manufacturers slashed selling prices in the face of a glut of PV modules on the world market.

That surplus was aggravated by a sharp change in policy in China midyear. The government acted to cool the country’s solar boom by restricting access for new projects to its feed-in tariff. The result of this, combined with lower unit costs, was that Chinese solar investment plunged 53% to $40.4 billion in 2018, says BNEF.

“2018 was certainly a difficult year for many solar manufacturers and for developers in China,” remarks Jenny Chase, BNEF’s head of solar analysis. “However, we estimate that global PV installations increased from 99 GW in 2017 to approximately 109 GW in 2018 as other countries took advantage of the technology’s fiercely improved competitiveness.”

The biggest solar projects financed included the 800 MW NOORm Midelt PV and solar thermal portfolio in Morocco at an estimated $2.4 billion and the 709 MW NLC Tangedco PV plant in India at a cost of about $500 million.

BNEF points out that offshore wind was a major recipient of clean energy investment last year, attracting $25.7 billion, up 14% on the previous year. Some of the projects financed were in Europe, led by the 950 MW Moray Firth East array in the North Sea at an estimated $3.3 billion, but there were also 13 Chinese offshore wind farms starting construction for a total of some $11.4 billion.

David Hostert, head of wind analysis at BNEF, says, “The balance of activity in offshore is tilting. Countries such as the U.K. and Germany pioneered this industry and will remain important, but China is taking over as the biggest market, and new locations such as Taiwan and the U.S. East Coast are seeing strong interest from developers.”

Onshore wind saw $100.8 billion of new asset finance globally last year, up 2%, with the biggest projects reaching go-ahead including the 706 MW Enel Green Power South Africa portfolio at an estimated $1.4 billion and the 600 MW Xcel Rush Creek installation in the U.S. at $1 billion.

Among other renewable energy sectors, investment in biomass and waste-to-energy rose 18% to $6.3 billion, while that in biofuels rallied 47% to $3 billion. Geothermal was up 10% at $1.8 billion, small hydro was down 50% at $1.7 billion and marine was up 16% at $180 million. Total investment in utility-scale renewable energy projects and small-scale solar systems worldwide was down 13% year-on-year at $256.5 billion, although the gigawatt capacity added increased.

Other categories of investment showed mixed trends in 2018, says BNEF. Corporate research and development (R&D) spending slipped 6% to $20.9 billion, while government R&D rose 4% to $15 billion. There was a 20% increase in public markets investment in specialist clean energy companies, to $10.5 billion, with the biggest initial public offerings including $1.2 billion for Chinese electric vehicle (EV) company NIO, $852 million for Chinese EV battery maker Contemporary Amperex Technology, and $808 million for French solar developer Neoen.

Global venture capital and private equity investment jumped 127% to $9.2 billion, the highest since 2010. The biggest deals were $1.1 billion of expansion capital for U.S. smart window maker View and $795 million for Chinese EV firm Youxia Motors. In fact, there were no fewer than eight VC/PE financings of Chinese EV specialist companies in 2018, totaling some $3.3 billion.

Looking at the 2018 clean energy investment numbers by country, China was again the clear leader, but its total of $100.1 billion was down 32% on 2017’s record figure because of the plunge in the value of solar commitments, according to the report.

Jon Moore, chief executive of BNEF, comments, “Once again, the actions of China are playing a major role in the dynamics of the energy transition, helping to drive down solar costs, grow the offshore wind and EV markets, and lift venture capital and private equity investment.”

The U.S. was the second-biggest investing country, at $64.2 billion, up 12%. Developers have been rushing to finance wind and solar projects in order to take advantage of tax credit incentives before they expire. There has also been a boom, in both the U.S. and Europe, in the construction of projects benefiting from power purchase agreements signed by big corporations such as Facebook and Google.

Europe saw clean energy investment leap 27% to $74.5 billion, helped by the financing of five offshore wind projects in the billion-dollar-plus category. There was also a sharp recovery in the Spanish solar market, helped by heavily reduced costs, and a continuation of the build-out of large wind farms in Sweden and Norway, offering low-cost electricity to industrial consumers.

More on BNEF’s 2018 clean energy investment figures can be found here.